Bids Wanted for Fixed Income Trading

The process for selling securities at specified tolerance amountsSUMMARY

- Bids Wanted is a methodical process financial advisors may use to sell a given security in fixed income trading

- Advisors are busy and need to be able to quickly skim what they’re trading on and be alerted of updates asap

MY ROLE

Lead designer for Bids Wanted; collaborated with two product leads and another product designer whose focus was fixed income search.

Overview

Within the Wove platform is a dynamic Trading app that advisors, central trading teams, and trade managers all use for numerous investing tasks.Fixed income trading involves buying and selling securities, and are especially complex because of the broad search net that traders must cast across thousands of bonds and then fine tune to find what matches.

A key step within selling fixed income securities is gathering bids, typically known as initiating Bids Wanted. Due to the volatility of the market and additional firm-specific rules, an advisor or trader must have total clarity to reduce chance of error and make accurate reports in audits.

Opportunities

The Bids Wanted process included real-time secondary market pricing, external checks against price discrepancies for below market bids, instant feedback on bid activity, and an underlying data engine called BondWise.

All together, these elements made up the somewhat disconnected steps that would need to be integrated into the Wove ecosystem.

So here was the ask:

- Recreate bids wanted process in full--including all required content across multiple different screens and processes

- Give the user necessary feedback that bids had been received or passed on in real-time during market open hours

-

Give users the clarity to know when they make key decisions, such as opting to accept a bid outside of a fair value

Solutions

Per the product team, the key steps and content really couldn’t be reduced, but it could be clarified. I spent most of my time understanding the flow as a whole, questioning why certain steps needed to proceed others, and the like.

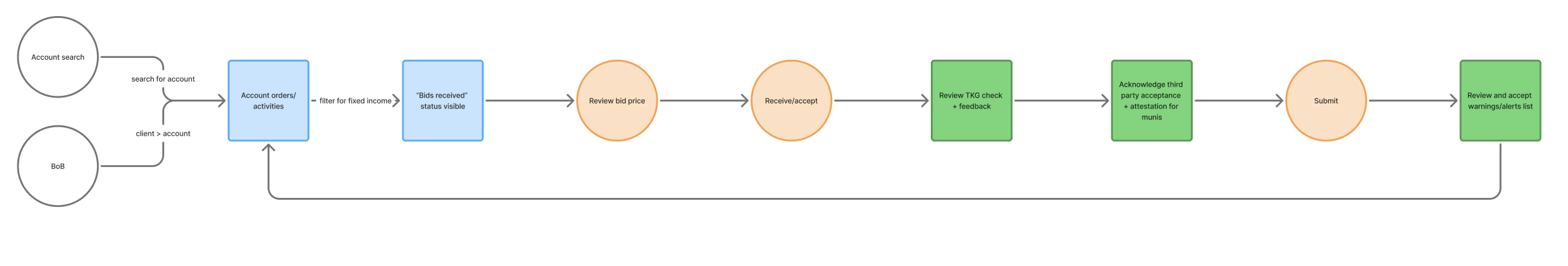

![The user flow chart I mapped became a daily reference point throughout the design process]()

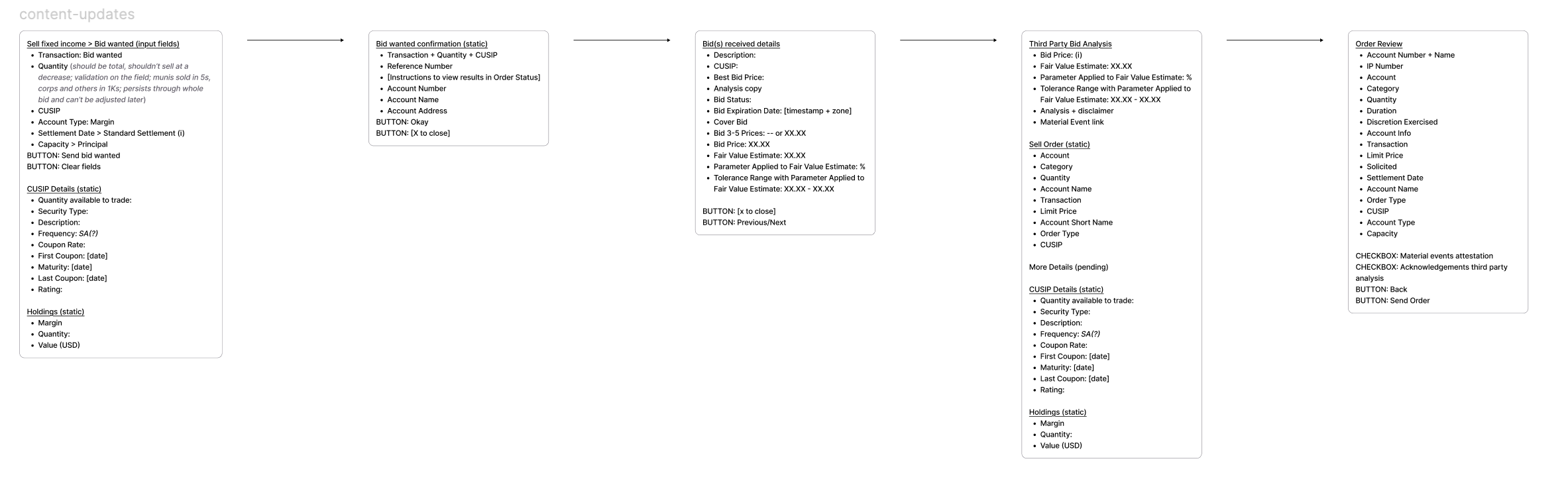

![The content architecture was crucial to understand myself so that I could make it clear for even an inexpert user]()

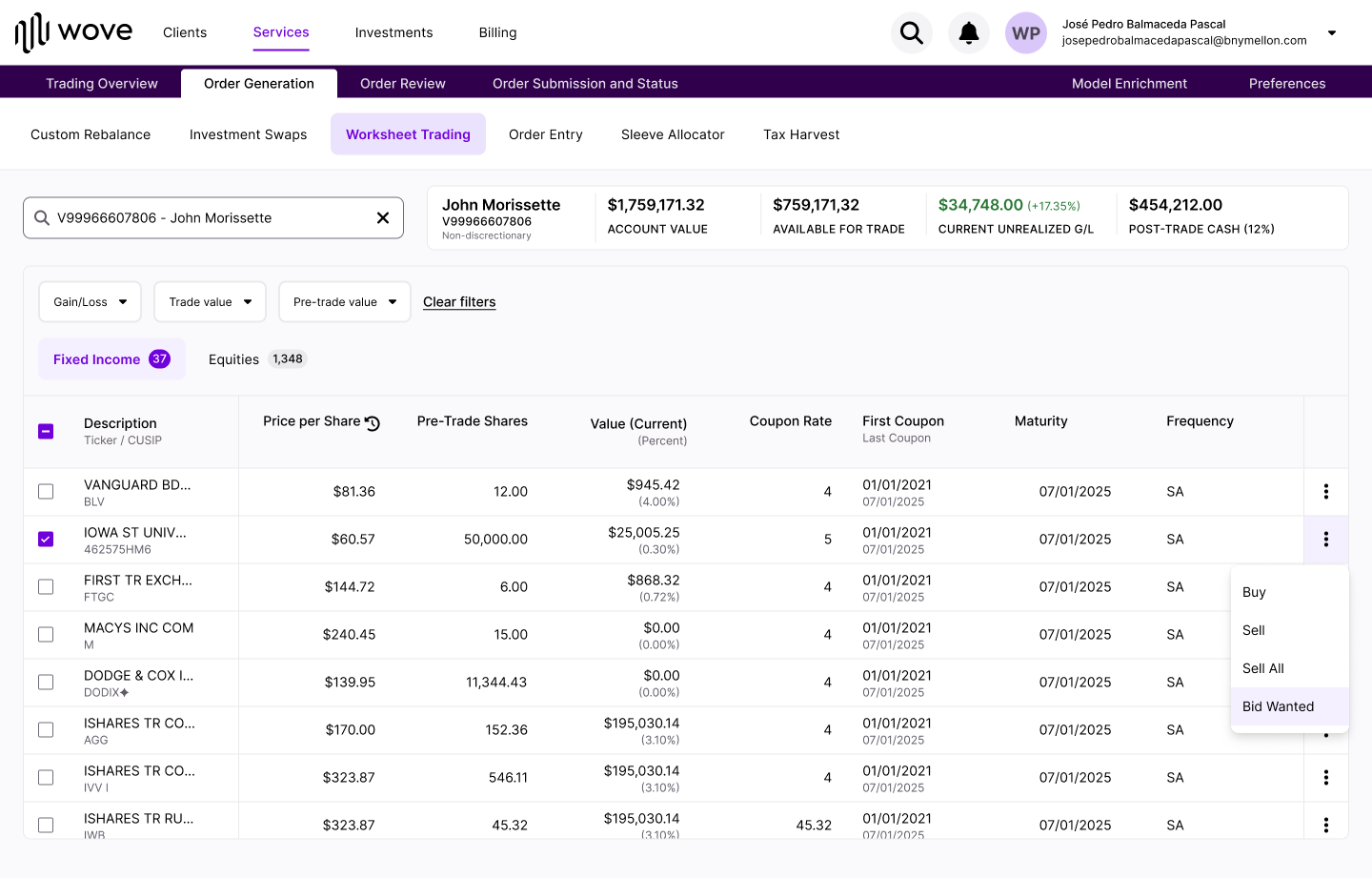

After multiple iterations refining the content and flow, I settled on the paradigm of a “ticket order,” which aligned with another flow in the platform.

This approach involved the initial dense table of search results, a few specific actions in the table, and a side panel form to allow for additional editing and submission.

![User selects "Bid Wanted" from the appropriate security row...]()

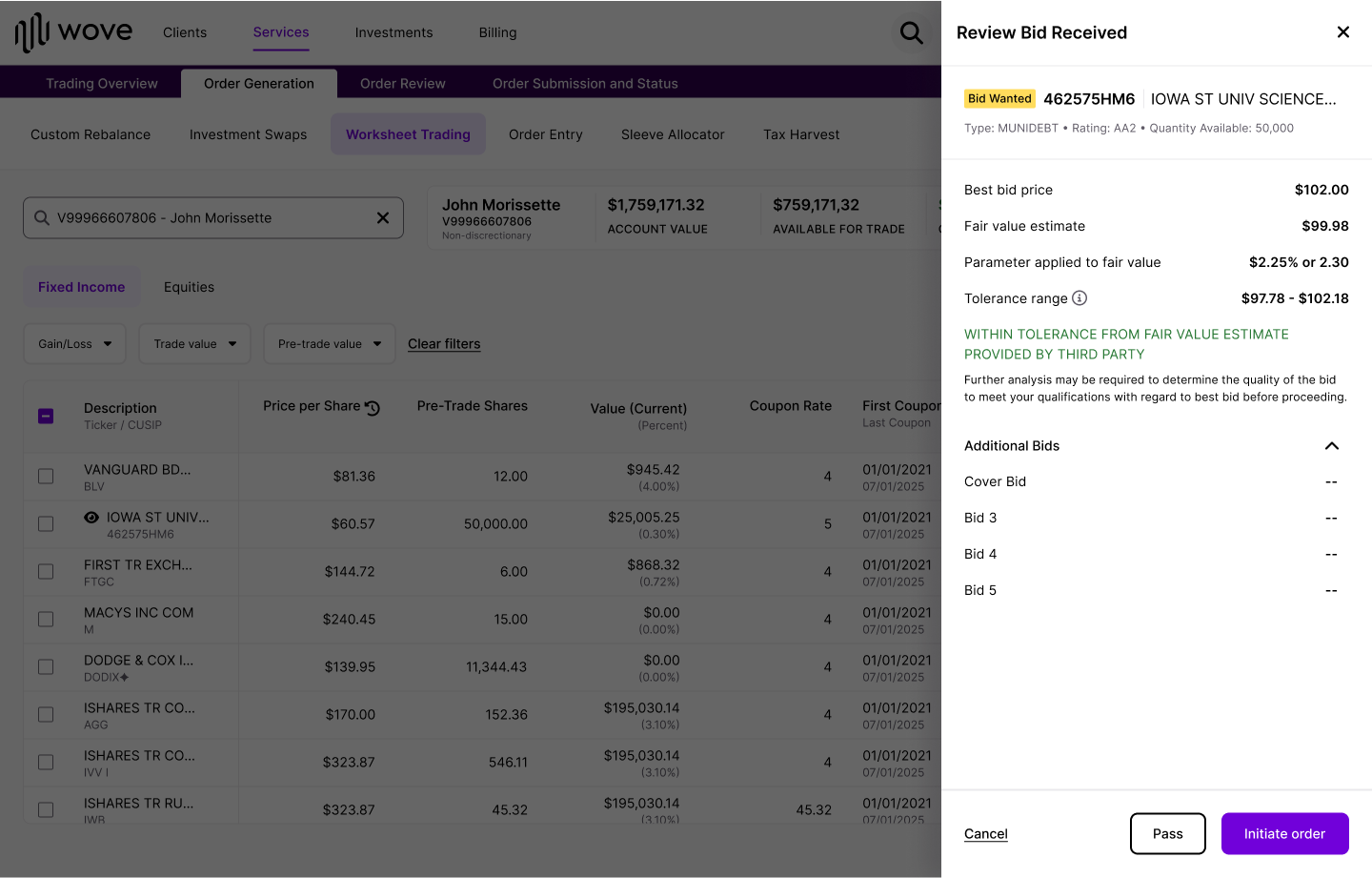

![Which triggers the side panel form, allowing some content to remain visible]()

Once the system receives a bid, the user is notified and can review and accept, triggering the same side panel, but now with third party analysis included and a CTA to finally initiate the sell.

One of the most crucial content areas of the flow was the Review Order screen at the end. While I had tried to imitate the legacy system of stuffing all of the content into a modal, I thought it seemed too error-prone and too easy to close the pop up, miss the required attestations, and halt the sell without realizing.

I opted instead to pare down they key data points for the sell order into a worksheet, and further disseminated this Review Order page as a template for any other designers working in Trading to use in any similar trading flows.

Trade-offs & Takeaways

I watched over the shoulders of our product counterparts multiple times to understand the nuances of the flow, and it became increasingly evident that an advisor would need to do this process repeatedly to have mastery. But because a typical advisor wouldn’t be doing fixed income trades and garnering bids often at all, I needed to focus on making the content concise and hierarchical.Customers were shown this flow during a product roadmap demonstration at industry conference Insite. The feedback included positive sentiments for this and the rest of the fixed income segment of the Trading app to be unveiled.

Upon delivery I’ll hope to gain better insight and validate whether this refined flow does in fact make it clearer, less error-prone, and maybe even faster for some.